Are you buying commercial property for the first time?

There are a number of reasons commercial property are attractive for property investors.

Higher yields, better cash flow and a wider variety of commercial property assets available at widely different price points are all reasons that make commercial property investment attractive to investors.

The actual process of conveyancing for a commercial property is largely the same as a residential property.

But whilst the process is relatively similar, the variety of factors at play in the purchase of a commercial property are far greater and therefore a far greater depth of due diligence is required when transacting these assets.

Whether a first-time buyer or a seasoned campaigner with respect to commercial property, ensuring you have partnered with an experienced and knowledgeable commercial property conveyancer in Melbourne is crucial to obtaining the advice you need to be sure the property you’re buying is right for you.

Here are three considerations you want to make when purchasing commercial property – and the five questions you should ask your conveyancer or lawyer before engaging their services to assist you.

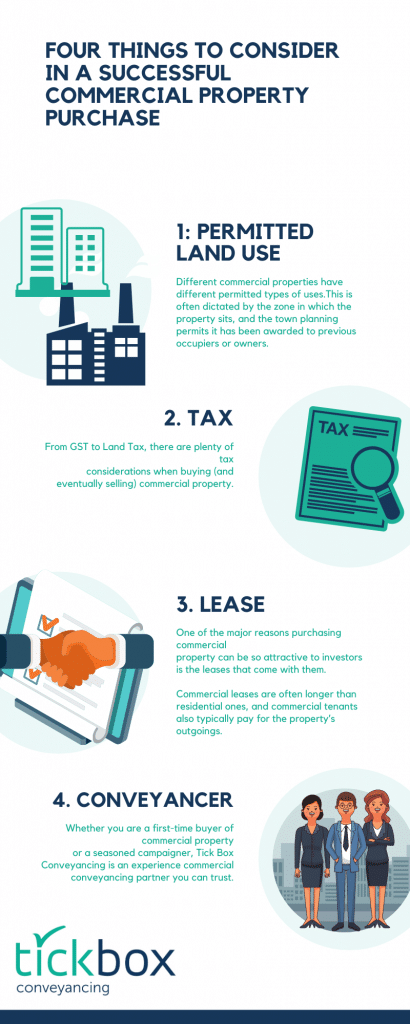

Permitted Use of the Land for Commercial Property

Different commercial properties have different permitted types of uses.

This is often dictated by the zone in which the property sits, and the town planning permits it has been awarded to previous occupiers or owners.

This is a crucial consideration when purchasing a commercial property because its permitted types of uses will determine what you or your tenants can do with the property and the sorts of businesses that can operate from it.

You should ensure your conveyancer or lawyer acting on your behalf in the transaction of a commercial property can quickly identify and report on the permitted use of land as part of their pre-purchase reporting.

Tax and Commercial Property

From GST to Land Tax, there are plenty of tax considerations when buying (and eventually selling) commercial property.

When purchasing a commercial property, you want to ensure you are partnered with a conveyancer or other legal representative who has demonstrable experience in understanding the tax implications of purchasing commercial property.

At Tick Box Conveyancing, we have the experience and expertise to guide our commercial clients with respect to the various taxes that come into play when buying and selling commercial property.

To make things even easier for our clients, we liaise directly with a purchaser client’s trusted advisers, such as accountants, to ensure there is a complete understanding of the situation and can obtain and provide advice that is simple to understand and easy to action for our clients and their advisers.

Leases

One of the major reasons purchasing commercial property can be so attractive to investors is the leases that come with them.

Commercial leases are often longer than residential ones, and commercial tenants also typically pay for the property’s outgoings.

But as always, the devil is in the detail.

- Is the lease a commercial lease or a retail lease?

- What are the differences between the two?

- How long does the lease have left to run?

- What is the tenant paying in rent?

- What is the yield likely to be?

As part of any pre-purchase review, your appointed conveyancer or legal representative offers when assisting you with a commercial property purchase – whether it’s your first or your fifth – an in-depth review of the existing lease (if one exists) is a must-have.

Tick Box Conveyancing includes this as a standard inclusion in all commercial conveyancing pre-purchase reviews.

Need commercial conveyancing services in Melbourne?

Whether you are a first-time buyer of commercial property or a seasoned campaigner, Tick Box Conveyancing is an experience commercial conveyancing partner you can trust.

Get in touch today about your commercial conveyancing needs!

Recent Comments